By now, Apple certainly qualifies as a silicon company. It can be seriously compared to Qualcomm, Broadcom, or pretty much any other chipmaker:

Apple releases a new generation of chips every year.

They are able to innovate (e.g., UWB technology).

The main difference is that Apple makes significantly more money, as they are also an OEM, selling approximately 200 million iPhones a year.

From mobile chips to the cloud

So how did Apple go from making mobile chips to building data centers? To understand that, let’s go over some of the most crucial the most crucial silicon moments in Apple’s history

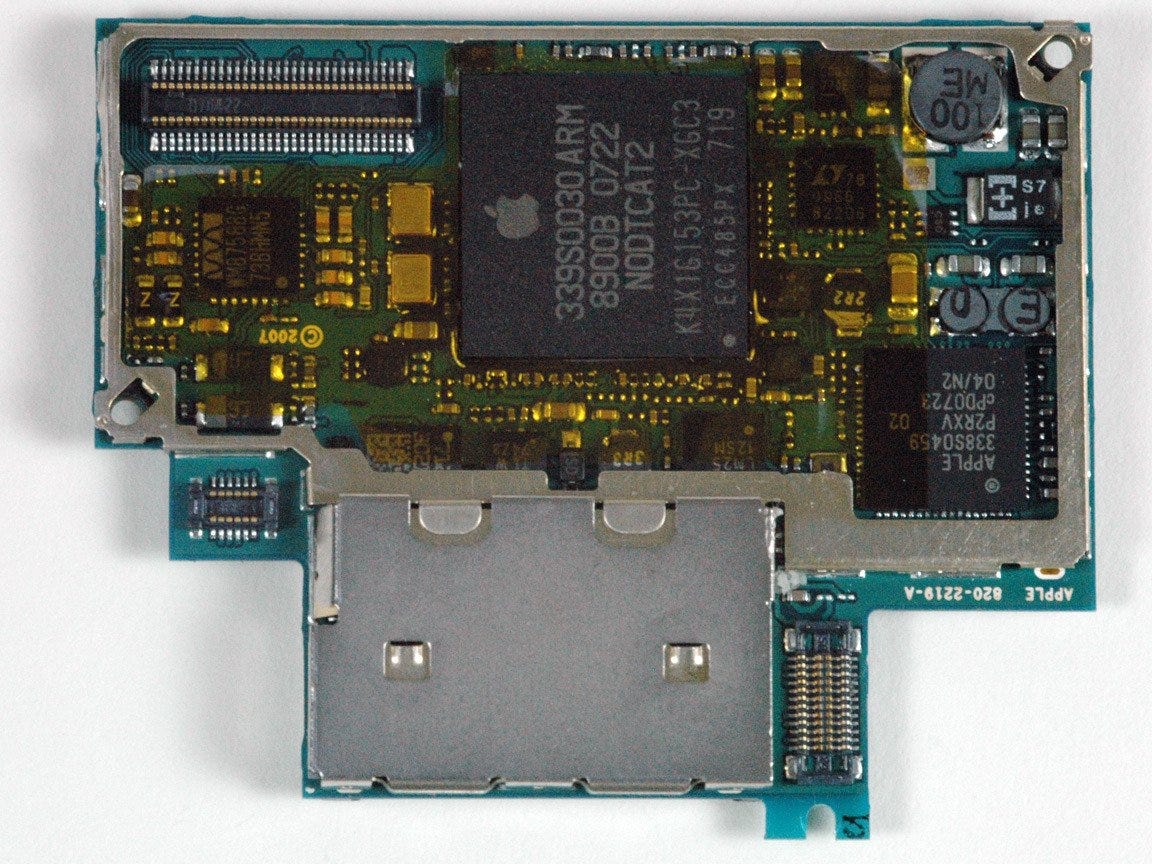

In the first iPhones, Apple used chips from Samsung and Infineon. Some of these chips even featured an Apple logo, hinting at what was to come — replacing these chips with their own. At the time, Steve Jobs approached Intel about producing chips for the iPhone, but Intel declined, believing Apple's volume and pricing demands were unrealistic. They underestimated the importance of the mobile market and remained committed to their x86 architecture, confident they could adapt these chips for mobile use. However, ARM-based designs were more power-efficient and better suited for mobile devices. By 2013, the significance of this Intel’s "miss" was clear to everyone, and it had far-reaching consequences for the company.

In 2008, Apple acquired P.A. Semi, a chip design company. This move marked the beginning of Apple’s gradual transition to designing its own chips. The first Apple silicon was the A4 application processor, introduced in 2010, which powered the iPhone 4 and the first iPad. It was an ARM-based chip built on Samsung’s 45nm technology, marking the start of Apple’s custom silicon journey.

This was followed by the A5 and A6, and eventually, with the A11, Apple’s application processors were branded “Bionic.” While "bionic" typically refers to the integration of biological functions with electronic components, in this case, it referred to the introduction of the Neural Engine, which enabled early AI features like Face ID. Since then, Apple has continued to use the “Bionic” name to emphasize the importance of the Neural Engine in their chips.

A18 and A18 Pro Silicon

Some weeks ago, during their “Glowtime” event, Apple unveiled its new A18 and A18 Pro SoCs, fabricated using the second-generation 3nm process node, likely referring to TSMC’s updated N3E technology. These ARM-based chips likely incorporate the SME ARM extension to enhance vector and matrix processing capabilities. The CPU and GPU are approximately 30% faster than the previous generation. The A18 chip features a 16-core Neural Engine for running large generative models, doubling the speed of previous versions. AI capabilities have clearly become a significant selling point for iPhones this year, with many features being hardware-accelerated.

Apple is pushing the integration of AI at the edge, enabling users to run multiple generative models directly on their devices. This is an interesting shift, as now 200 million users will start utilizing Apple Intelligence at the edge. However, not all processing occurs on the device itself. Some prompts will still be send to Apple's cloud infrastructure, which reportedly runs on Apple Silicon. This highlights the importance of fast 5G chips in bridging the communication between cloud and device—a critical link in Apple’s technology stack. Apple will closely monitor the most-used AI features and, over time, introduce hardware acceleration for them, just as it did with the advanced media features in the A18 Pro. The same hardware advancements are being implemented across other devices, like AirPods and the Apple Watch.

Strategic acquisitions

Apple’s silicon journey extends far beyond its A-series chips. Apple’s silicon story is much more interesting and deeper than just their A-series chips. they started with mobile chips and the Bionic SoC and their next move was to design an in-house power management system. So, to do that, they acquired Dialog Semiconductor in 2018. This was a smart move, as power management is the second most critical component in mobile devices after the SoC. By designing these chips in-house, Apple can tightly integrate them into its stack, maximizing power efficiency and reducing dependence on external suppliers.

The next major step in Apple’s silicon strategy came with the transition of its MacBooks to Apple silicon. Before 2006, Apple used IBM PowerPC chips, then switched to Intel, which provided a leap in performance. In 2020, Apple introduced the M1 chip, marking its legendary shift from x86 to ARM architecture for laptops. This transition unified Apple’s chip architecture across all its devices, from iPhones and iPads to Macs, and delivered a major blow to Intel, which has yet to recover.

Apple’s silicon innovation extends to all of its products. AirPods, for example, feature W-series chips which then evolved to the H-series chips, along with Apple-designed power management and noise-cancellation hardware. Over the last few years, Apple has acquired over 100 companies in areas such as memory controllers, 3D sensing, AI, AR, and more.

One notable acquisition was Intel’s wireless business in 2019, which allowed Apple to develop its own 5G chipsets. This was a significant move, especially considering Apple’s tense relationship with Qualcomm. However, developing an in-house modem has proven technically challenging, and Apple extended its deal with Qualcomm for a few more years. The iPhone 16 Pro is expected to use the Snapdragon X75 chipset, which reportedly costs over $100 per unit. Despite the expense, Apple is willing to pay for faster 5G connectivity while working toward eventually replacing Qualcomm’s chips with its own.

Below, I discuss why replacing Qualcomm's 5G chipset is such a big deal for Apple and why they are building chips for their own data centers.

Keep reading with a 7-day free trial

Subscribe to Deep in Tech Newsletter to keep reading this post and get 7 days of free access to the full post archives.